6 Smart Moves to Make Before Setting Up Power of Attorney

Thu Jan 2026

In legal and financial matters, clarity goes a long way. The borrower writes a promissory note to confirm their commitment to repay the debt under specific terms and conditions. Unlike a casual IOU or handshake deal, a promissory note formalizes the loan agreement, often including the amount, repayment schedule, and any interest or late penalties.

In the context of debt collection in Brampton, this document can be a pivotal asset. Whether you're an individual lender, a contractor, or a small business owner, having such documentation can transform the way outstanding debts are pursued and recovered.

Debt recovery can get complicated when expectations aren't clearly defined from the beginning. Many disputes arise not because someone refuses to pay but because both parties have different interpretations of what was agreed upon. A promissory note mitigates these risks by establishing a clear, written understanding.

It also plays a crucial role when legal assistance is involved. Paralegals assisting with debt collection in Brampton often rely on written documentation to substantiate claims in small claims court or during negotiations. A well-drafted promissory note streamlines this process, offering a more straightforward path to resolution.

A promissory note doesn't just record a transaction—it becomes a strategic tool that paralegals and creditors can utilize. Below are five situations where it can have a direct impact on debt collection in Brampton.

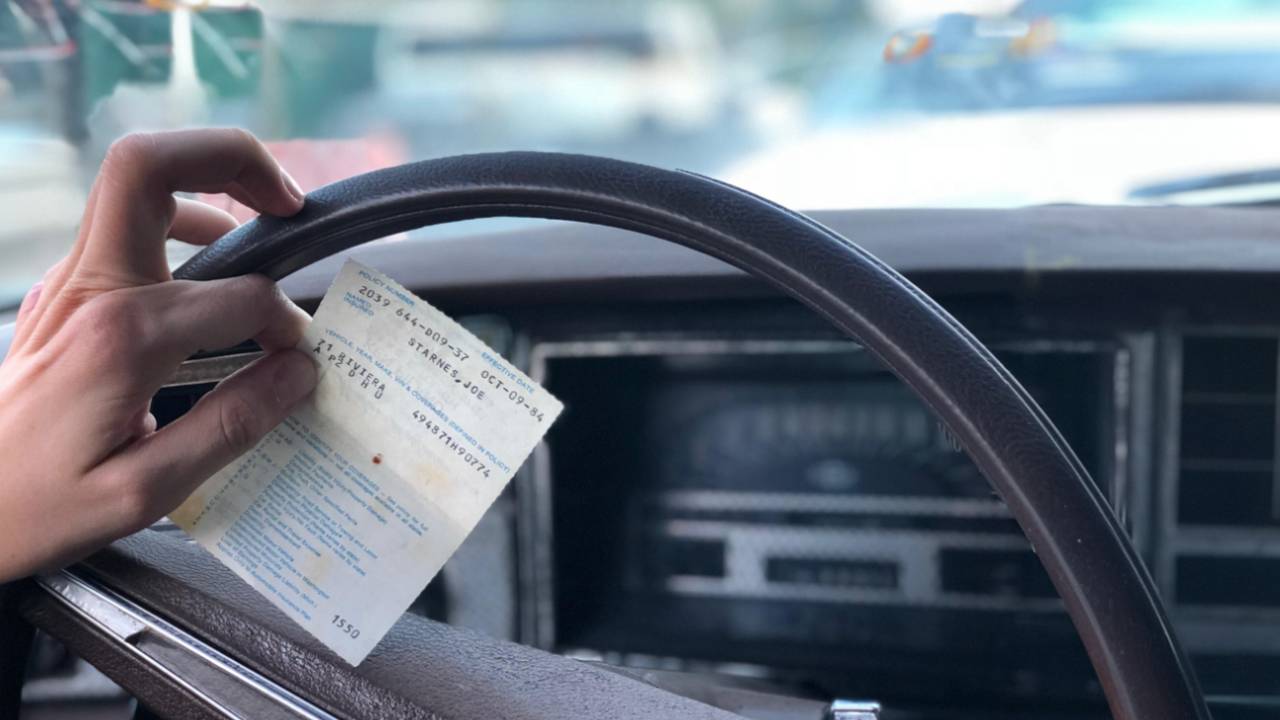

Verbal agreements are legally risky. They may work for small, informal loans, but they offer little legal footing if the borrower defaults. A promissory note, on the other hand, creates a paper trail. It outlines the loan terms, repayment method, and borrower's obligation, all of which can be used in legal proceedings.

If you've already loaned money informally, it's not too late. You can still request a retroactive promissory note that reflects the original arrangement, which can be helpful for future enforcement if needed.

Life happens, and sometimes borrowers ask for extensions. Instead of relying on text messages or email chains, a revised promissory note provides a legally consistent update to the original terms. It helps ensure that both parties are aligned and gives the creditor renewed leverage in the event of continued non-payment.

For paralegals managing debt collection in Brampton, this simple update can be the difference between a stalled recovery and a timely resolution.

Loans between friends or family members often skip formal agreements, which is understandable, but it can cause complications if repayment becomes an issue. In these situations, a promissory note can help by clearly outlining expectations without straining the relationship.

If things do go south, this document becomes crucial evidence that the money was a loan and not a gift. When it comes to Debt Collection in Brampton, paralegals can use this note as the foundation for a formal recovery process, making it easier to pursue what you're owed legally.

One of the main reasons debts go unpaid is because of vague, informal arrangements. Saying “I’ll pay you back soon” isn’t a real plan—it’s just a delay tactic. A promissory note removes this uncertainty by clearly outlining the terms. For instance, it might specify that the borrower owes $1,500 to be repaid in three monthly instalments of $500 starting August 1st.

This level of detail serves two key purposes: it provides the borrower with a clear repayment schedule to follow, and it establishes a concrete legal basis for action if payments are missed. When it comes to Debt Collection in Brampton, having such documentation makes it far easier for paralegals or collection professionals to help recover what’s owed.

If repayment doesn't occur, the promissory note becomes your strongest piece of evidence. For paralegals assisting with debt collection in Brampton, this document speeds up court filings. It helps establish the validity of the debt. It can also support requests for remedies, such as wage garnishment or liens, depending on the situation.

The presence of a signed, dated agreement often increases the chances of a settlement before going to court. Borrowers are more likely to negotiate once they realize the lender has a strong legal position.

To be helpful in a legal context, the promissory note should contain the following:

Without these elements, the note may be open to challenge, reducing its effectiveness.

A promissory note is far more than a mere formality—it brings structure, accountability, and legal weight to any lending agreement. These qualities become especially important when debt issues arise. In a city like Brampton, where personal and business lending are typical, having a well-crafted promissory note can significantly impact the success of Debt Collection in Brampton.

Whether you need to formalize a new lending agreement or enforce an existing one, professional guidance can make all the difference. RG Notary & Legal Services offers expert support in drafting and leveraging promissory notes as part of effective debt collection strategies throughout Brampton.